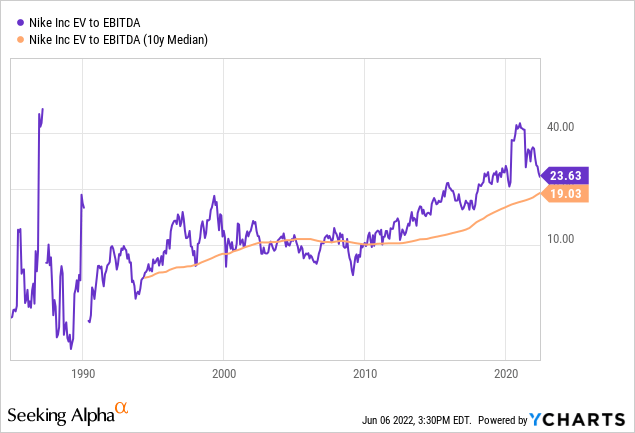

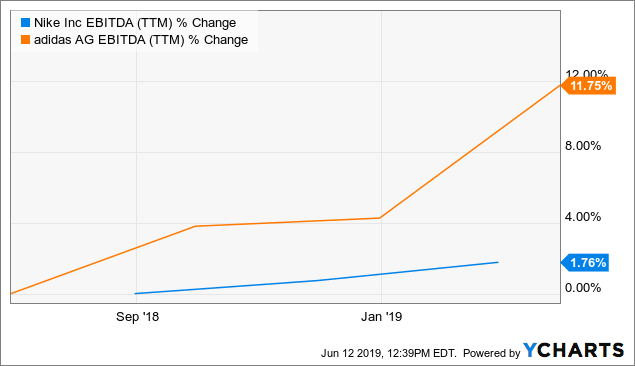

Nike vs Adidas: Where to Invest?. Nike and Adidas are both known brands… | by Kathleen Lara | Medium

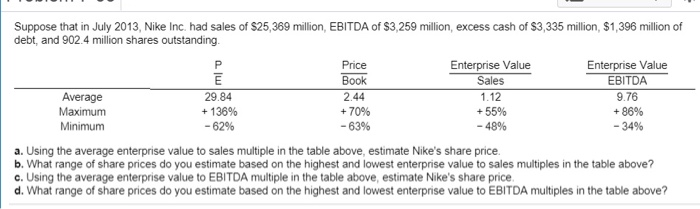

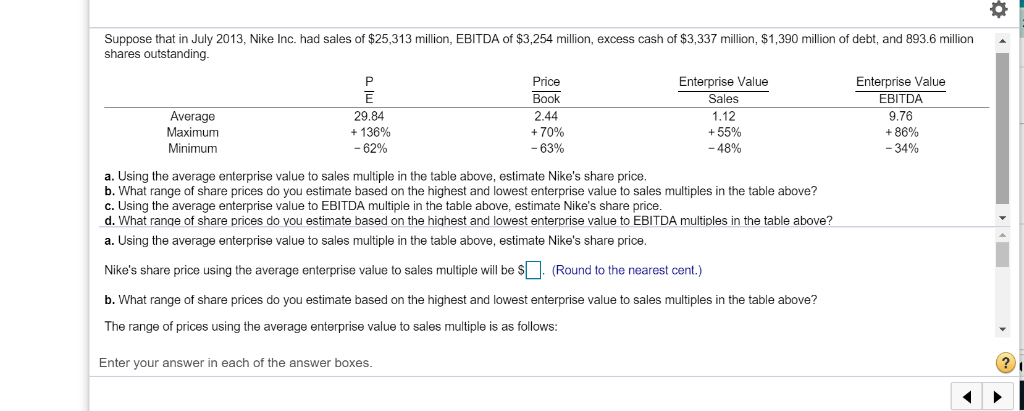

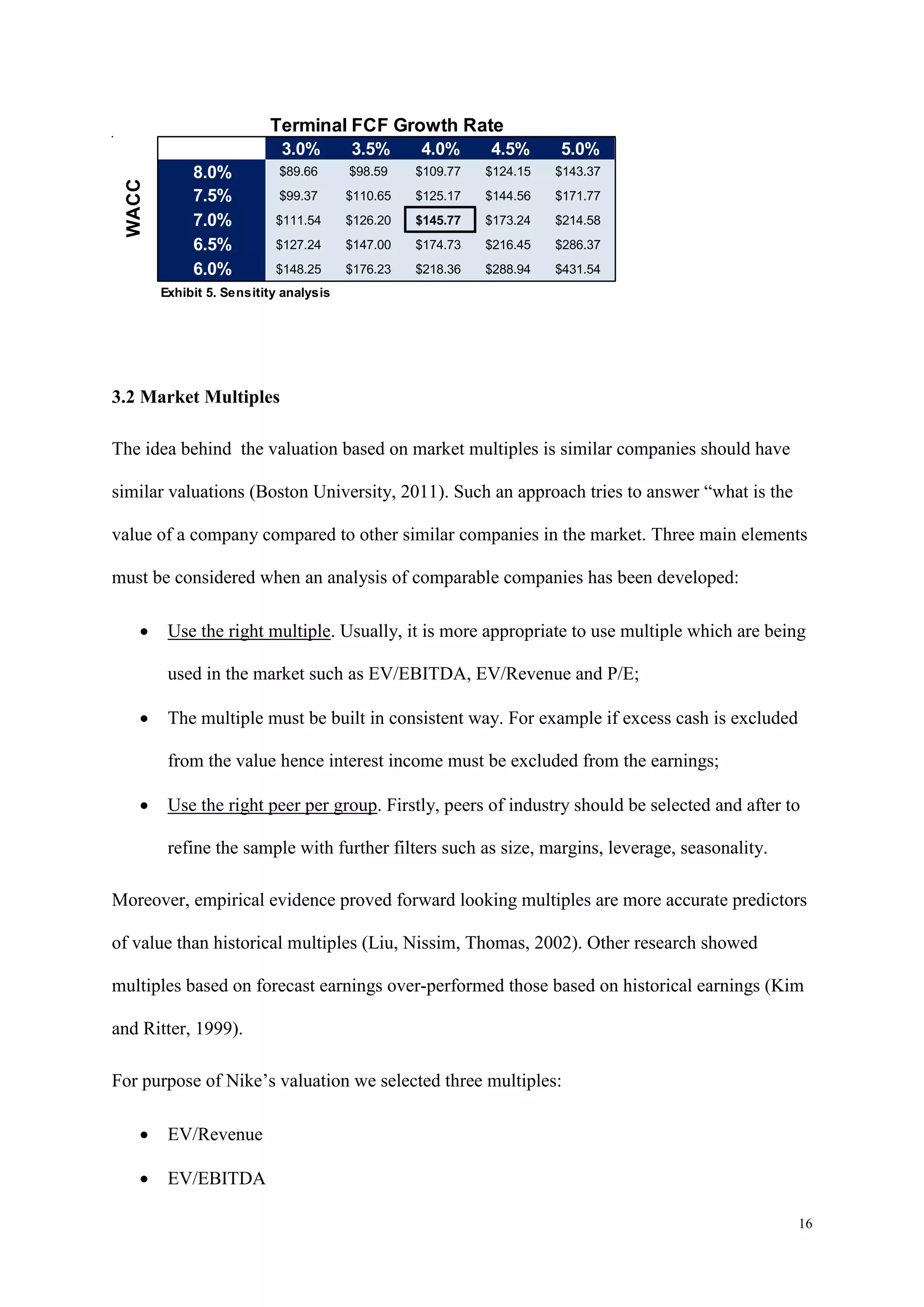

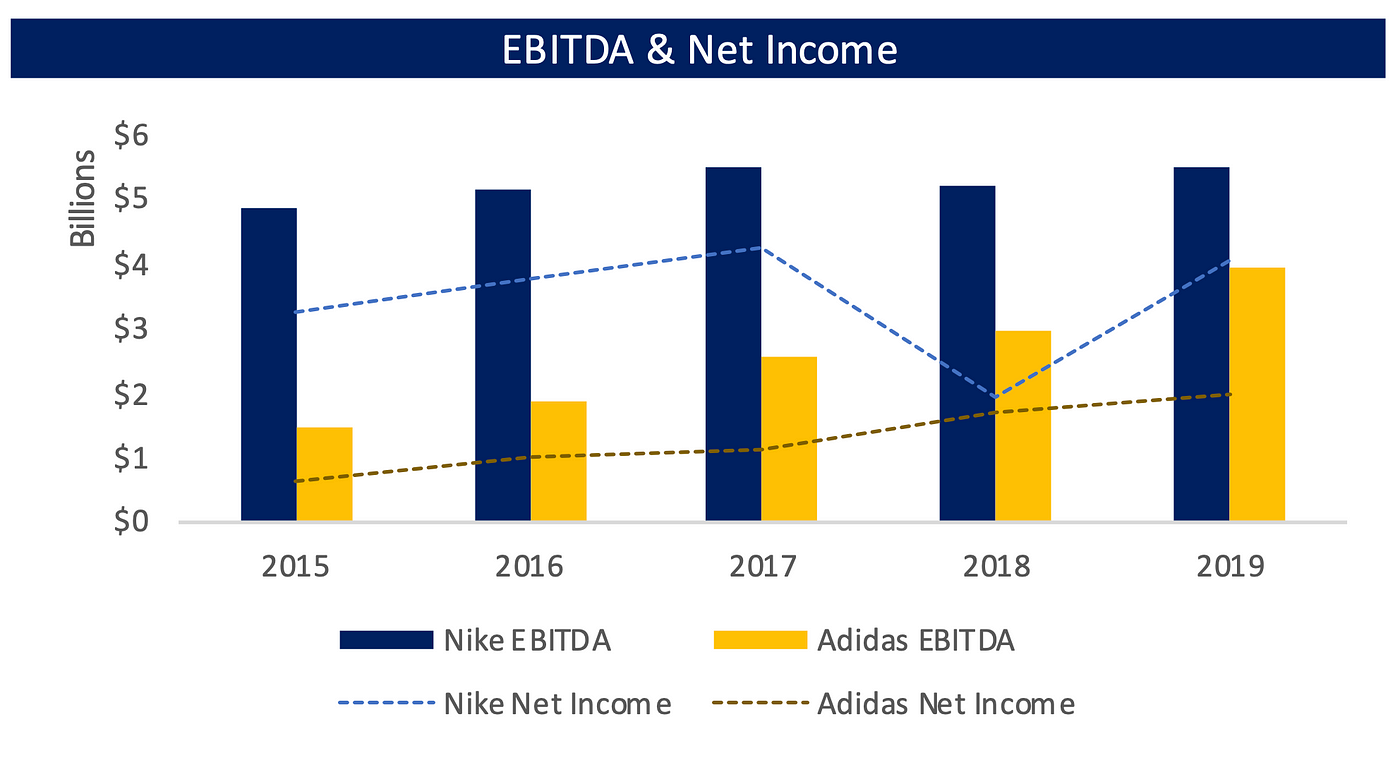

Problem 10-17.xlsx - Problem 10-17 Suppose that in July 2013, Nike had sales of $25,313 million, EBITDA of $3,254 million , excess cash of $3,337 | Course Hero